Introduction

The E-commerce business is on an all-time boom. The ease of rolling the e-commerce business has made it a mad rush, a race to attract, engage and convert.

Each business, big or small, seems to be getting it. Apps like Canva, Shopify, and Meta have made getting started easier and faster. These platforms make it simple to launch a logo, a store, and Meta ads promise quick visibility.

Naturally, most founders assume that’s the winning formula: build a Shopify store, run Meta ads, and wait for sales.

We’ve worked with several such founders, from leading furnishings labels, a premium rugs, carpets, and home furnishings brand, to emerging D2C labels, an affordable D2C apparel label. Both had good-looking products and active ad campaigns, managed by multiple agencies, even before we met them. But the results were underwhelming, to say the least. Their sales were inconsistent, returns were low, and brand recall was almost nonexistent.

Was there a brand at all? This was the major concern. Both the businesses carried their own self-image around the business intent and not the customer.

That’s when we stepped in – not to launch new ads, but to pause, audit, and rebuild from the brand up.

The Challenge

When we began digging, the problems were strikingly similar across brands, regardless of the category.

- A live Shopify store, but no clear brand identity behind it.

- Stores and campaigns lacked positioning and messaging, and, therefore, the connection.

- High abandoned carts and poor conversions.

- Weak UI/UX—visitors weren’t staying long enough to care.

- No content strategy, which meant ads led people to empty experiences.

- Zero SEO hygiene—missing keywords, unoptimized titles, and confusing menus.

- No audience tracking or retention systems—campaigns were flying blind.

Real Examples:

A Furnishing Brand’s Meta Campaigns

While auditing the furnishing label’s Meta campaigns, we uncovered a series of issues that were quietly draining performance.

The brand was positioned as a semi-luxury, but the campaigns told a very different story. A modest daily budget of around ₹1333 was split across three ad sets and nine creatives, spreading the impact too thin for Meta’s algorithm to optimise effectively.

Targeting was completely misaligned. The audience pool included employers of Hermès Peru, Bergdorf Goodman, Neiman Marcus, Prada, and Versace—aspirational but irrelevant for an Indian mid-premium brand. It even extended to the top 10% US zip codes and “in-college” education levels – groups unlikely to convert for handcrafted home décor.

The ad copy leaned heavily on discounts (“10% OFF”), which clashed with the brand’s “premium” positioning and diluted the story of design and craftsmanship that their products deserved.

The result? Confused algorithms, low CTR, poor ROAS, and wasted media spend. The brand looked torn between being luxury in appearance and discount in message.

A D2C Apparel Brand’s SEO Challenge

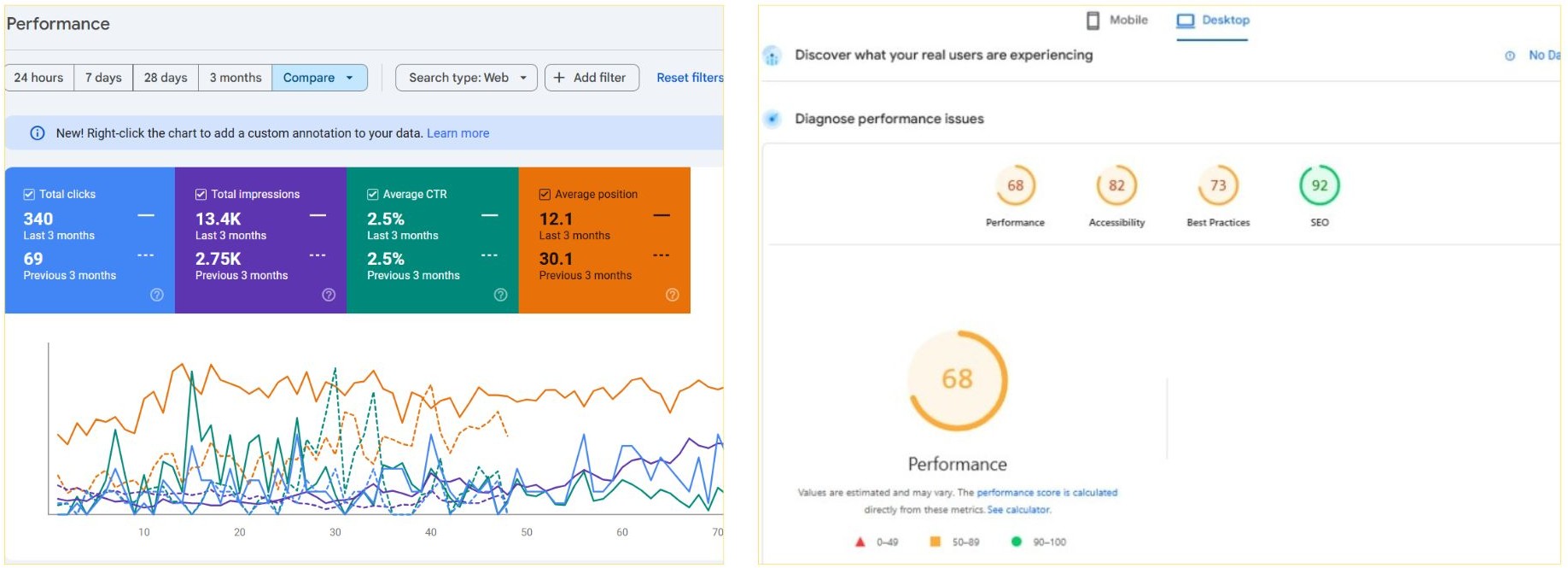

When we began working with this fashion label, a youth-oriented D2C apparel brand, the first impression was strong — trendy products, straight connect, and a clean Shopify store. But behind that, the numbers told a different story.

Despite steady ad spends and good engagement on Meta, organic visibility was almost nonexistent. The brand wasn’t ranking for even the most relevant keywords in its own category. Their products were being seen on social media but not being found by people actively searching for them – a huge missed opportunity for a digital-first label.

The gaps: Brand Story, Narrative turned into a Content Strategy, and Analytics

We ran a detailed SEO audit and discovered that product titles, descriptions, and tags lacked search intent. There was no keyword strategy in place, and the store was missing out on basic ranking opportunities.

The result?

High dependency on paid ads, limited organic traction, and inconsistent growth. The brand had awareness, but not discoverability.

Our Approach: Starting with a Brand Audit

Instead of fixing campaigns first, we began with a detailed brand audit, a deep dive into what was actually driving (or blocking) growth.

We mapped everything from brand positioning to store experience, from their communication to audience behaviour, and campaigns. The idea was simple: if the foundation isn’t right, no amount of media money can fix it.

This audit gave founders a clear picture showing what needed to change and why. It shifted the focus from “run more ads” to “build a stronger brand.”

The Solutions

From there, we rebuilt the growth engine layer by layer.

- Defined the brand story and positioning so every piece of content reflected purpose.

- Competition Analysis to define the Targeting so they know what to focus on, how, and why, as per their goals and buyer persona.

- Redesigned the Shopify experience. By switching to simpler navigation, cleaner product pages, and an easier checkout flow.

- Built a content plan that aligned with campaigns – brand storytelling, product narratives, and seasonal stories.

- Optimized SEO and product listings, adding persuasive titles and category clarity.

- Set up proper audience tracking and segmentation, creating custom and lookalike audiences that actually made sense.

- Streamlined Meta campaigns. Fewer ad sets, better creatives, and realistic targeting clusters.

For Furnishing’s, this meant moving away from “discount-first” messaging to emphasising design and craftsmanship. Establishing “Made in India” sentiment and underlining the legacy of their decades-old business.

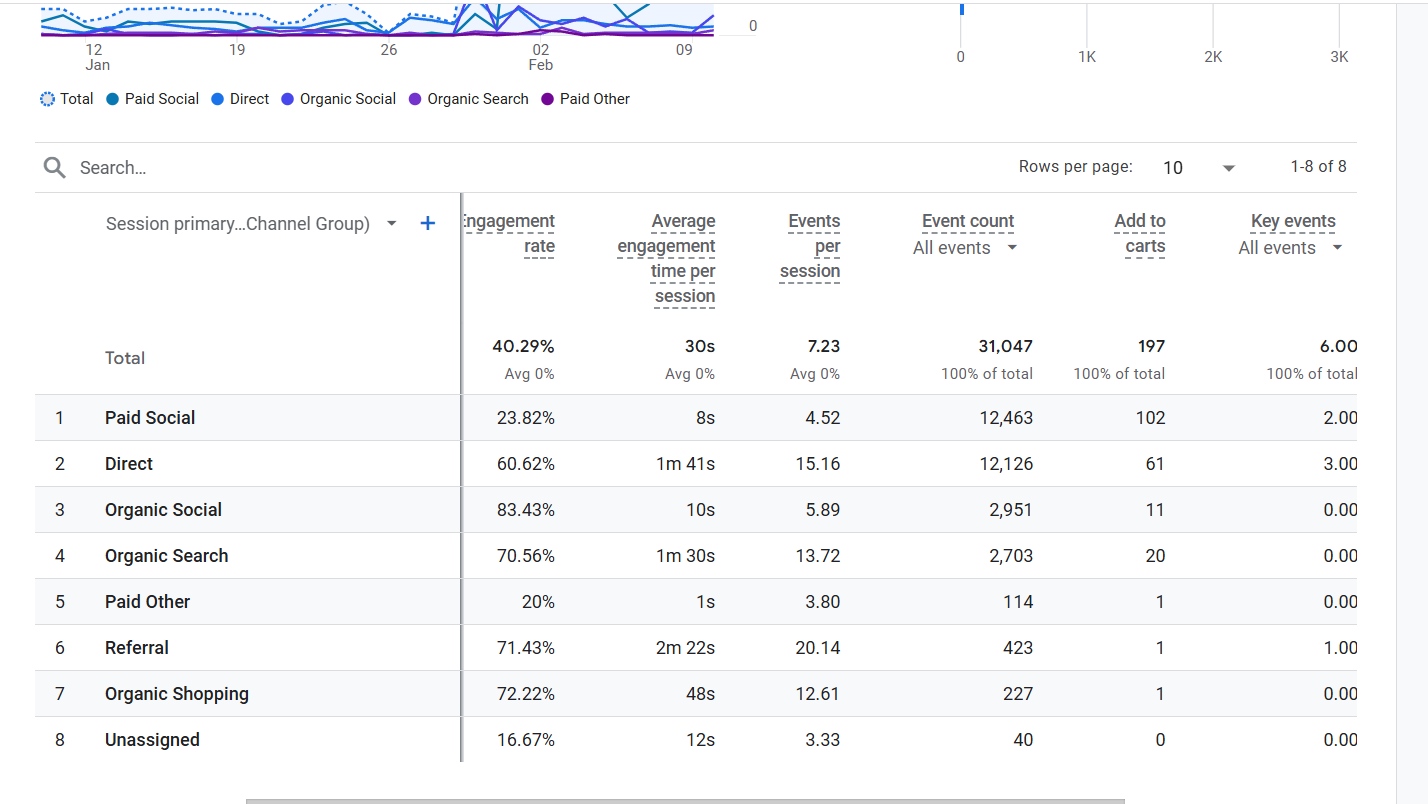

For D2C, it meant focusing on SEO and content that sustained traffic even after ads stopped.

The Impact

The results spoke for themselves.

Furnishings saw higher engagement, better-performing ads, and longer website sessions once the brand narrative and UX aligned.

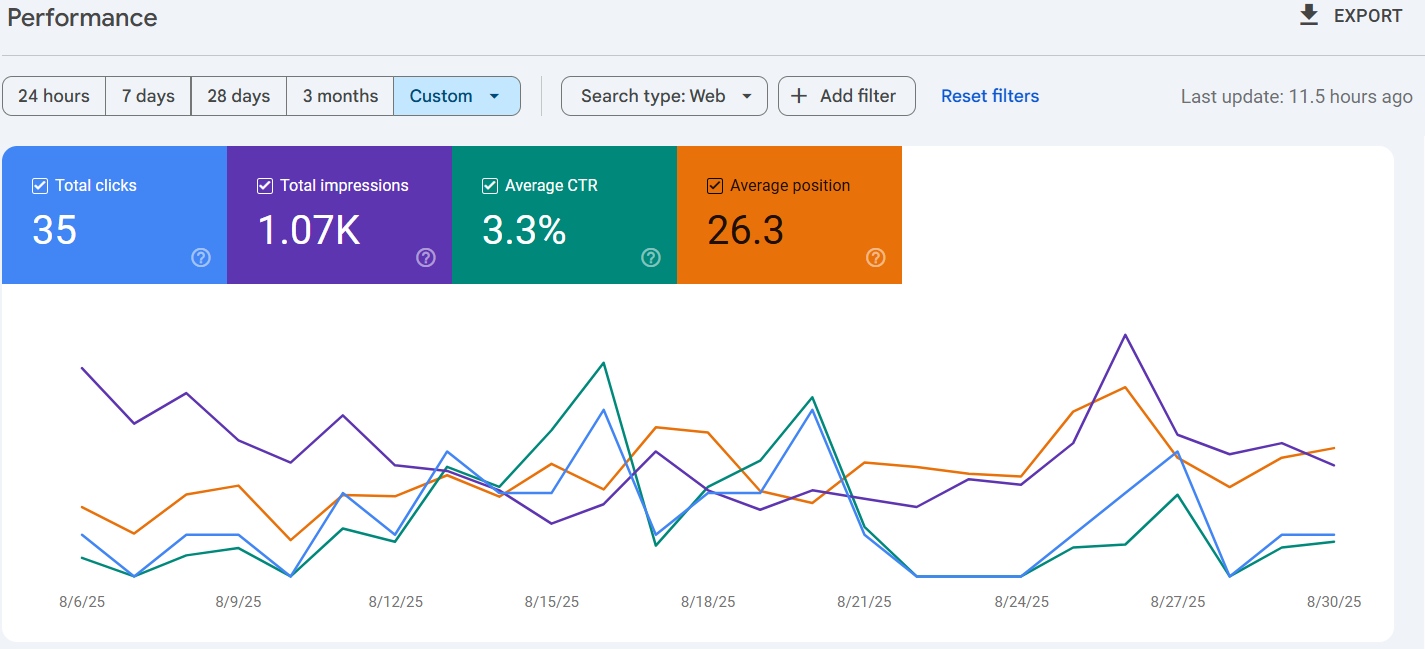

Before Optimization

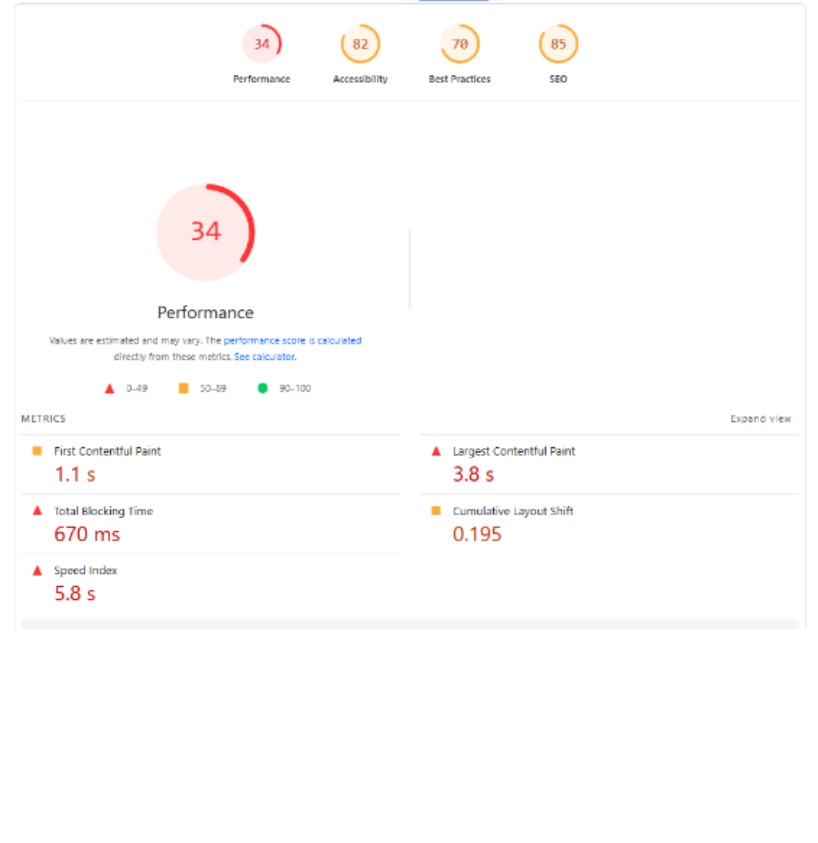

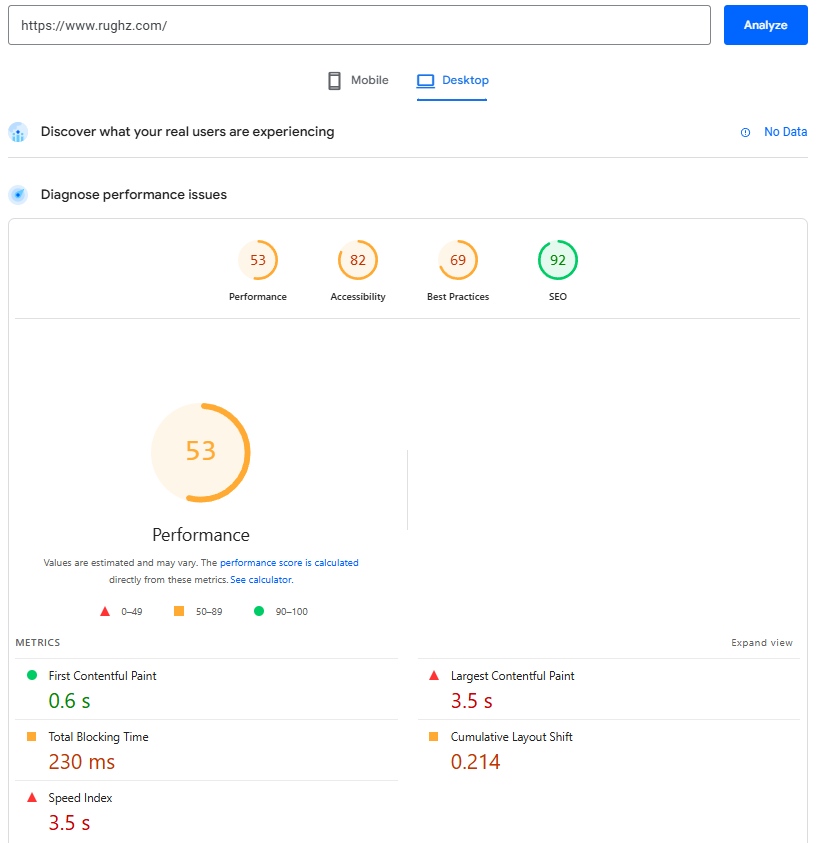

Optimization Stage One

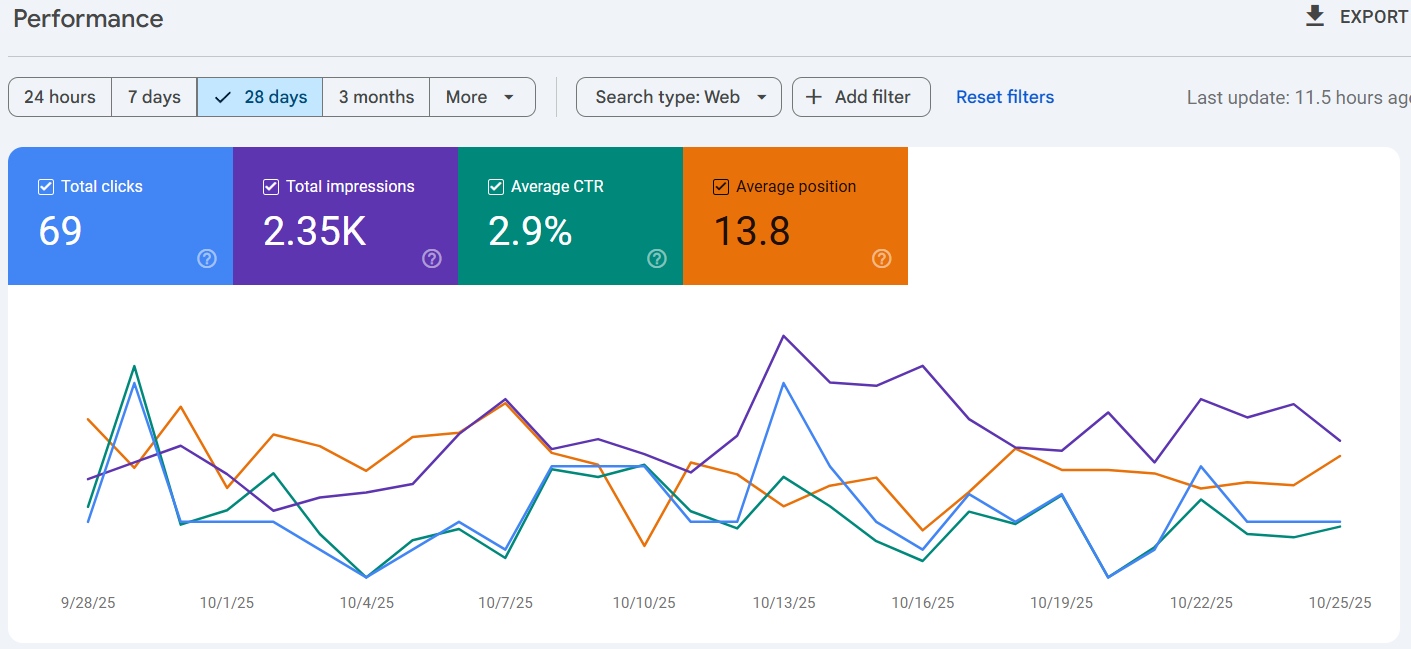

Optimization Stage Two

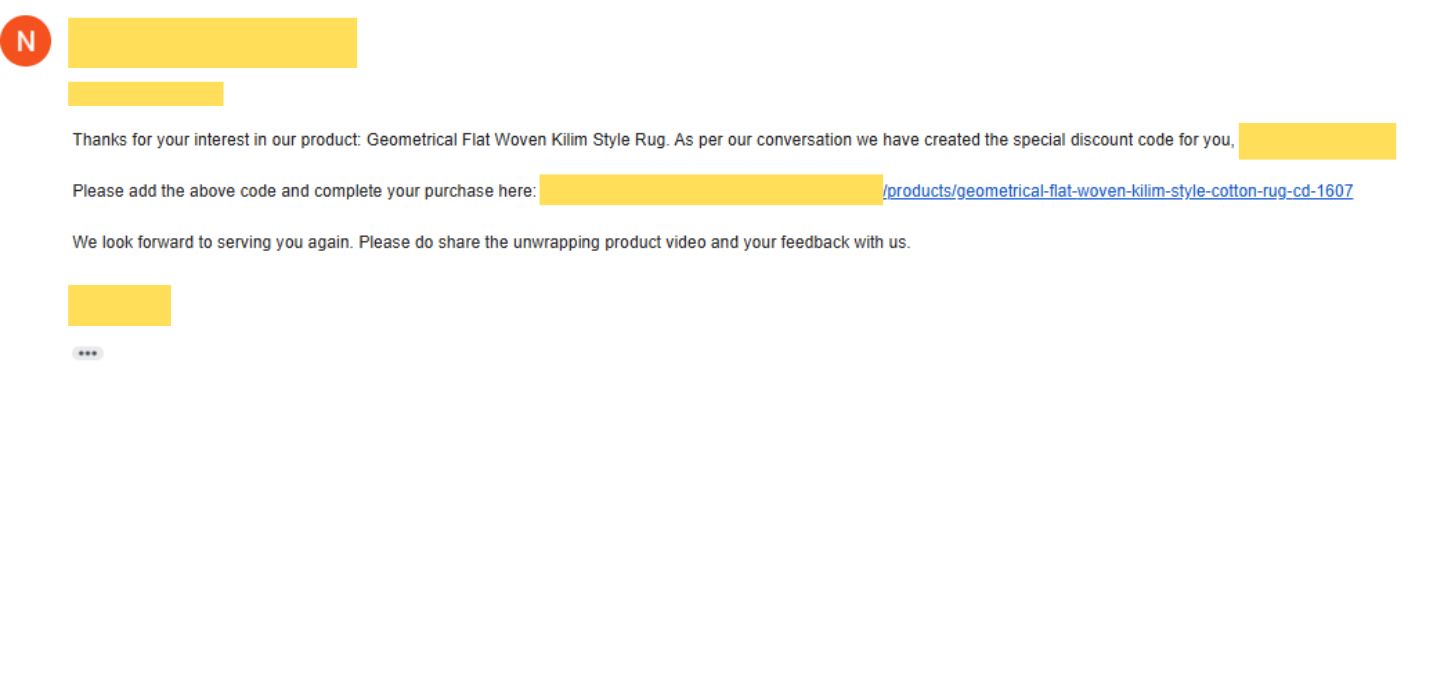

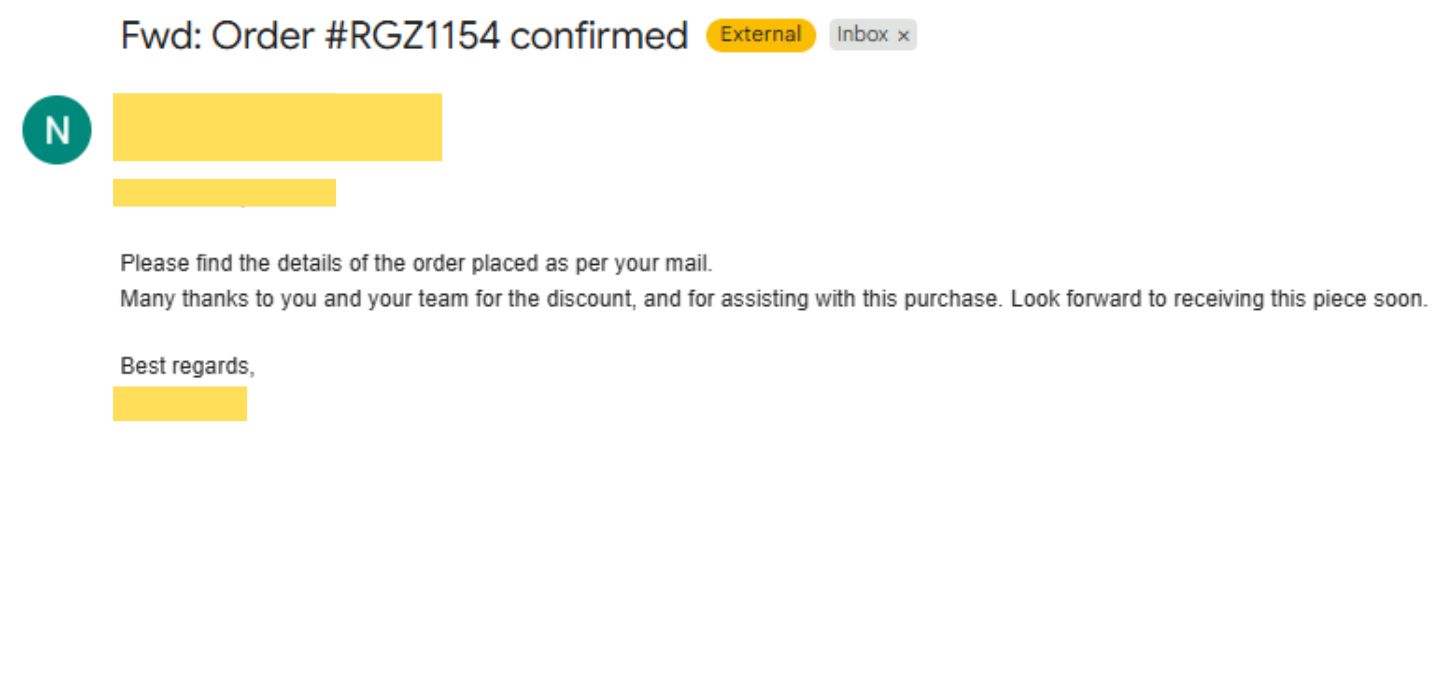

We also strengthened the customer flow by adding lead forms and automation. This made every customer inquiry instantly actionable, helping the team respond faster and build trust through human touchpoints.

One such instance captured the difference – a customer inquiry about a cotton dhurrie size turned into a ₹31,500 paid order within a day, simply because of quick, personalized follow-up. It proved how timely communication and a structured customer journey can turn interest into sales and trust into long-term loyalty.

D2C’s organic traffic grew steadily, and the brand started ranking for terms its customers were actually searching for.

Most importantly, both brands shifted their approach from chasing quick sales to building recall, loyalty, and repeat buyers.

That’s when growth becomes real, not just visible on dashboards, but sustainable in behavior.

Key Takeaways

What we learned through these audits is simple but often overlooked.

- Ads don’t build brands, alignment does. Sustainable eCommerce growth comes from coherence across every touchpoint, not just conversion-focused campaigns.

- Branding and marketing must speak the same language. Consistency across ads, website, and checkout builds trust and familiarity.

- Optimize your store experience. A seamless, intuitive design ensures visitors don’t just browse, they buy.

- Create a thoughtful content strategy. Keeps your brand visible, discoverable, and relevant even when ads are paused.

- Build genuine customer connections. Transparent communication and authentic engagement drive loyalty and advocacy.

- Leverage data-backed systems. Smart tracking, targeting, and retention turn short-term wins into long-term brand growth.

Without these, campaigns remain short-term experiments. You might drive sales for a season, but you won’t create recall, loyalty, or advocacy, the true signs of a brand built to grow.

Conclusion

Most eCommerce brands don’t fail because their ads are not apt. They fail because the foundation underneath those ads is broken.

At 30TH FEB, we learned that scaling an eCommerce business doesn’t start with Meta dashboards; it starts with clarity. When the story, strategy, and structure align, ads stop being a cost and start becoming a catalyst.

That’s when a store becomes a brand.